After the Gold Rush: What Comes Next for GLP-1s

Inside the post-compounding GLP-1 market: pharma’s pivot, DTC’s ceiling, and payer infrastructure at scale.

The weight loss drug market is shifting fast. Here’s what you need to know…

Bullets to sound smart with your friends (or your boss):

Compounding peaked at ~25% of scripts — a conservative estimate

Pharma snapped back: Novo cut Hims, Lilly sued

~29M Americans have tried a GLP-1 — most won’t stay on without infrastructure

Cigna now covers 9M+ lives in a GLP-1 wraparound program

Drug expense might pay off, if outcomes and retention hold

We used to light cigarettes to stay thin. Today, we inject. The method changed, the motive didn’t.

Smoking went mainstream before we understood the consequences. GLP-1s are doing the same: driven by demand, distributed with convenience.

But pharma is taking back the wheel:

Novo launched cash-pay Wegovy via NovoCare at $499/month — then ended a partnership with Hims over continued off-label compounding (source)

Lilly is offering Zepbound via LillyDirect — while suing DTC platforms in CA (source)

Hims is hedging with a ZAVA acquisition to expand GLP-1 sales in the EU (source)

Most commentary stops at “the what.” I wanted to understand why. So I spoke with drugmakers, national payers, and investors.

The GLP-1 boom was built on speed, not science — regulatory gaps, DTC playbooks, and cash-pay demand.

That chapter is over. Now that pharma is reclaiming distribution and payers are footing the bill, the question isn’t access.

It’s retention, side effects, and proof that care was worth it.

Early winners sold access. The next will sell outcomes.

How Compounding Fueled the GLP-1 Boom

GLP-1s aren’t new. The first was discovered in the early 2000s. Trulicity made them commercially relevant in 2014. Ozempic (semaglutide) built the modern market.

Demand exploded after Wegovy’s obesity approval in 2021.

Novo and Lilly weren’t ready. Injectables are hard to scale, and neither had the infrastructure to meet demand.

Then, the FDA added semaglutide (not Lilly’s tirzepatide) to its drug shortage list in 2022. That cracked open the door. Under Section 503A, compounders could legally recreate the drug without FDA approval. The rule was meant to solve scarcity, not subsidize unmet demand. But it was misused.

These weren’t true replicas. Compounders used alternate salt forms (e.g., semaglutide sodium or acetate), not found in FDA-approved formulations.

Still, it was enough. Telehealth platforms like Hims, Ro, and MochiHealth moved quickly. An online form, a brief consult, a monthly cash-pay charge — and the drug showed up at your door.

They bypassed insurers and PBMs, capturing ~5x the margin of branded Wegovy (source).

Access was the product. And startups knew how to sell it.

How Big Did Compounding Get?

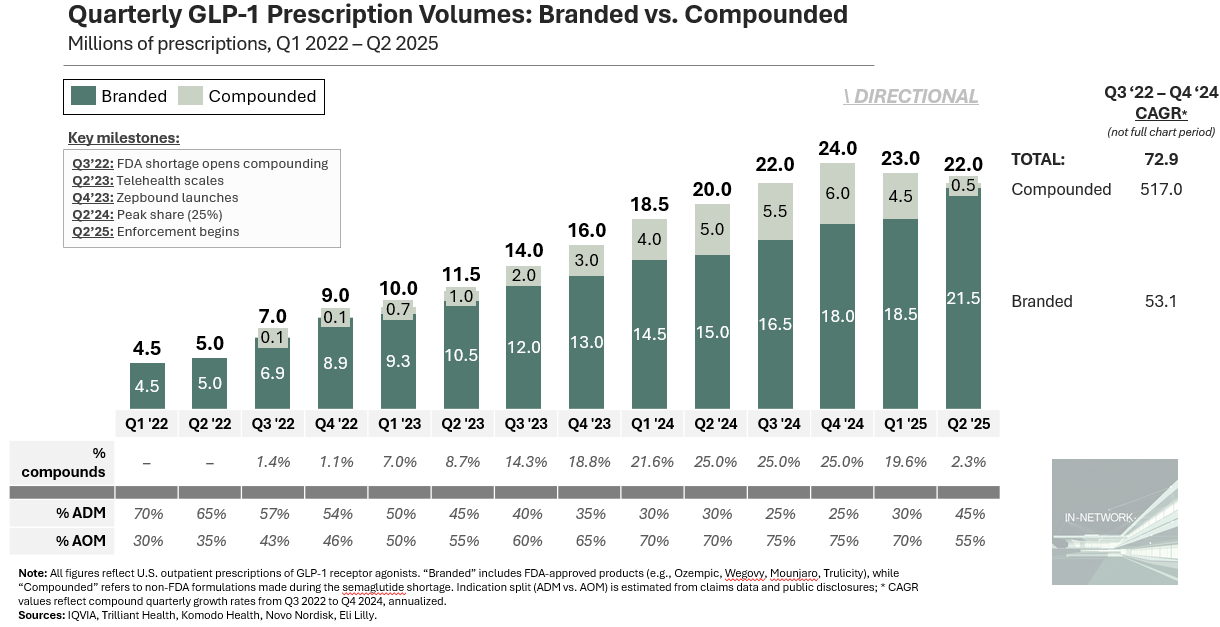

Compounded GLP-1 scripts aren’t directly tracked, but public disclosures let us triangulate a credible range. It’s popular to claim compounders reached 50%+ of total volume at peak. A more conservative approach suggests ~25%. Massive, but bounded. Here’s the math:

Total prescriptions: IQVIA and Truveta data show U.S. GLP-1 prescriptions grew from ~9M in Q4 2022 (source) to ~24M by Q4 2024 (source). Novo’s Q1 2024 earnings cited ~6.5M monthly scripts, consistent with that run-rate (source).

Novo’s estimates help bracket the range:

Floor (~15%): In early 2025, Novo said ~1M U.S. patients were still on compounds. At three fills per quarter, that’s ~3M scripts, or ~15% share (source).

Ceiling (~32%): Novo previously warned compounders “may have captured up to 40%” of semaglutide scripts. If semaglutide made up 80% of GLP-1 volume (before Zepbound), that implies compounded share closer to 32% (source)

Now, look at Hims: They launched compounded semaglutide in Q2 2024 and reported $225M in GLP-1 revenue through year-end (source). At a midpoint price of $299, that’s ~750K scripts over three quarters, or ~250K per quarter. That’s 4 – 5% of the estimated 6M compounded scripts at peak. If Hims — one of the most visible platforms — held just 5% of compounded volume, then 50%+ estimates for the total market probably overstate reality. But a 25% share? That holds up. And it’s still staggering.

Could it be higher? Maybe.

But ~25% is a defensible midpoint, not a stretch.

How Pharma Took Back Control

At first, compounders weren’t a major threat; Novo and Lilly benefited from the hype. But as volumes scaled, so did their losses.

“We have reduced our full‑year outlook due to lower‑than‑planned branded GLP‑1 penetration, which is impacted by the rapid expansion of compounding in the U.S.”

Former Novo CEO Lars Jørgensen, May 2025

The FDA ended the semaglutide shortage exemption soon after.

At first, Novo and Lilly played it differently:

Novo chose offense. They had first-mover advantage, and compound exposure. As share bled, they moved fast: discounts, DTC partnerships, and cash-pay deals. Volume over defensibility.

Lilly chose defense. Tirzepatide (Mounjaro, then Zepbound) wasn’t on the shortage list, so compounders couldn’t touch it. Lilly also had the stronger molecule and a deeper pipeline. Weight loss was strategic, not existential. They held firm: no DTC, no discounts, early payer alignment.

Then, this week, Novo terminated its deal with Hims, citing Hims’ plan to continue compounding “personalized doses” outside the branded spec (source). The clinical risk — adverse events tied to Novo’s name — wasn’t worth the extra volume.

Hims’ retort? Novo is being anti-competitive:

Who’s right isn’t the point. Novo is playing it smart.

Pharma is shifting from weight loss drugs to cardiometabolic platforms. The model: stack indications, expand labels, and reposition semaglutide and tirzepatide for broader use — heart failure, CKD, NASH, addiction. Any one of these opens the door to Medicare Part D, which still excludes weight-loss drugs under the MMA.

For my pharma savvy folks, this is the Keytruda playbook. Opdivo was first, but Keytruda won by expanding faster — 38+ approvals across cancers. Today, it’s one of the top three highest-grossing drugs on earth.

Pharma sees where the long-term value lives, but it’s not guaranteed.

Novo’s recent CagriSema data (a sema+cagrilintide combo) underwhelmed, wiping out $90B in market cap (source). The market has already priced in label expansion. Any stumble hurts.

Why DTC GLP-1 Platforms Are Struggling

Not all virtual prescribers are “DTC.” Platforms like Calibrate, Season, and even Noom Med offer coaching and lab integration, gesturing towards outcomes infrastructure.

Ro, Hims, and Mochi are different — more conversion engines than clinics. No RCM stack, no care coordination, no PCP partnerships. Great for Viagra. Risky for chronic care.

They’re clever, and they’ll keep iterating. Hims said it would keep offering compounds, so their stock jumped. But I haven’t seen a viable turnaround path:

If Hims can legally compound personalized doses — dose flexibility won’t solve nausea, muscle-loss, or tapering needs (source).

If Ro duct-tapes coverage — they still need to manage claims, prior auth, and retention. They’re not built for it. (source)

If ZAVA gives Hims an international escape valve — demand exists, but price tolerance doesn’t. EU payers won’t subsidize unproven, compounded drugs. (source)

If the rise and fall here feels familiar, it is.

Testosterone therapy followed a similar arc: cultural hype, DTC boom, quiet fade. But the risks were tolerable, and the market too small to trigger regulators. Vault, Hone, and others drifted away.

GLP-1s are different. The stakes are higher, and the burden of proof is heavier. DTC isn’t equipped. And this time, the system won’t look away.

How Payers Are Building GLP-1 Infrastructure

Despite the hype, we’re far from saturation. By script volume, GLP-1s have reached 20–25M Americans. KFF polling puts it at 29M who’ve tried one, with 14M still on therapy (source). But that’s out of 260M adults — not just the 100M with obesity.

Many will need to go again. Twelve month dropout rates hit 65% for obesity and 47% for diabetes (source).

And when patients stop, the results reverse. In one trial, Wegovy users regained two-thirds of the weight within a year of stopping (source).

It’s tempting to assume payers will push back. But commercial plans aren’t just preparing to cover these drugs — they’re building infrastructure around them.

Cigna is all-in. Through Evernorth, it covers Wegovy and Zepbound for obesity, capping out-of-pocket costs at $200/month (source). Over 9M people have joined (source). To support that scale, it launched two dedicated assets:

EnReachRx: clinical wraparound services

EnGuide: a GLP-1-trained pharmacy team

They’re not alone. CVS Caremark made Wegovy its preferred GLP-1 (source). More broadly:

Employer coverage is scaling fast: 64% of America’s largest employers now cover weight-loss drugs, up from 56% a year ago (source)

PBMs are locking in controls: CVS Caremark, Express Scripts, Optum Rx, and Prime are adding GLP‑1s to formularies with step edits, prior auths, and exclusions (source)

We’re at a real infection point. Soon, these drugs may also have demonstrable ROI.

One Aon study found that weight loss plus comorbidity improvement offsets costs — even at high drug prices.

This tracks. Weight loss improves diabetes, sleep apnea, heart risk, and productivity. But only shows if side effects like muscle loss, nausea, and behavioral drift, are managed.

That takes real clinical support. The next winners won’t just prescribe. They’ll support, retain, and prove outcomes.

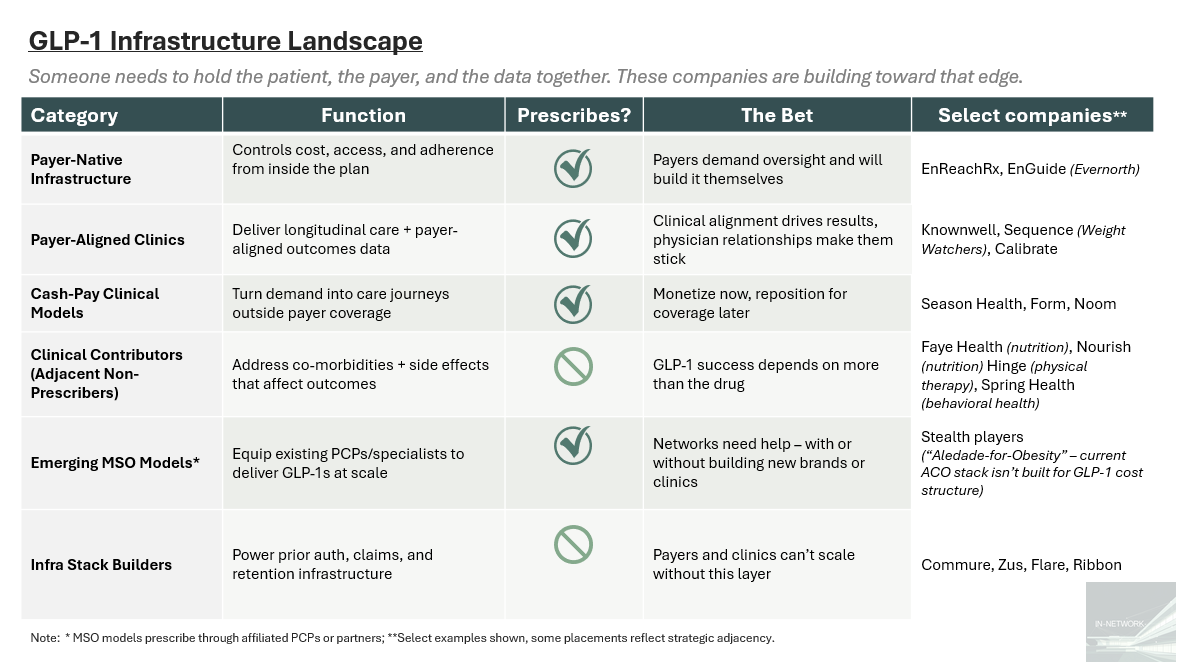

Here are a few of the players building toward that edge, and some thoughts on what matters:

Payer-native infra is where control lives. Cigna’s EnReachRx and EnGuide show that payers want full stack oversight, and they’re building it in-house.

Payer-aligned clinics are sticky but still early. Knownwell, Calibrate, and Sequence offer outcomes and trust. But PCP FFS economics and brick-and-mortar burn are headwinds.

Cash-pay clinics are loud but capped. Without payer alignment, Season and Noom stay small, or get boxed out.

Clinical contributors are overlooked but essential. Nutrition, PT, and behavioral support shape adherence, even if they don’t prescribe.

The MSO chassis is still missing. GLP-1s don’t fit Aledade’s mold — slower ROI, higher drug risk, and heavier infra needs than your typical ACO.

Infra builders quietly shape. Prior auth and retention ops are invisible until they break. Zus or Commure could become the rails beneath everything.

What Comes Next for GLP-1 Formulations

Getting the script is easy. What comes after — side effects, behavior change, clinical infrastructure — is still being built.

This phase won’t be the last. Orals, long-acting injectables, and combos are on deck.

The first wave of GLP-1s broke open access. The next will decide who owns the model.

Here are a few ways future formulations could shift the market:

Oral (Rybelsus 2.0, better semaglutide formulations)

What changes: Easier to prescribe and adhere to, but worse tolerability

Where it moves: Into primary care → lower friction, tighter payer control

Strategic shift: More access, same adherence problem

Risk: Higher churn, more side-effect driven dropout

Next-gen combos (e.g., GLP-1 + GIP + amylin, muscle-sparing)

What changes: Better outcomes, better tolerability

Where it moves: Into specialist-aligned care models → deeper payer integration

Strategic shift: Drugs become platforms — unlock long-term value

Risk: Slow coverage without strong RWE; clinical complexity slows uptake

Long-acting or micro-dosages (e.g., monthly injections, microneedle patches)

What changes: Improved tolerability, better adherence

Where it moves: Possibly back toward DTC models if access outpaces infra

Strategic shift: Less patient burden, potential wedge for intermediaries

Risk: Manufacturing lag or cost may stall rollout; regulatory catch up needed

As new formulations come to market, expect bundling logic to follow. First-gen GLP-1s may serve as the access wedge — volume-driven, high-cost, tightly controlled. Next-gen combos, with better outcomes, get positioned as the upgrade. Think Humira-to-Rinvoq: maximize total revenue under the curve, even if it means discounting your lead drug to drive adoption of what’s next.

That’s the revenue strategy, outcomes TBD.

We solved access. Now we have to earn it.

At least until the next formulation arrives.

If you’re building in this space — payer-side, platform-side, or somewhere in between — reach out. Would love to hear how you’re thinking about what’s next.

💭 If this sparked something—hit the 💜 or leave a comment. I’d love to know what’s worth unpacking next. Or forward it to someone building in the space.

Liked this one? You might also like The Ambient Scribe Stack — a breakdown on how companies like Abridge, Ambience, and DAX are going beyond the note to rewire clinical workflows.

In-Network is where I write about the business of care: models, margins, and the infrastructure behind how we deliver it.

→ Subscribe for sharp, honest analysis on what’s actually changing in healthcare.