Ambient Scribes: A Reasonable Bet, With Conditions

Clinicians love it. Boards fund it. But growing into a $5B valuation won’t be easy.

TL;DR: Ambient scribes are the rare AI tool doctors actually like. But most of them still fail to scale. This post breaks down what works, what breaks — and what might actually stick.

Bullets to sound smart with your friends (or your boss):

Clinicians love it. Boards fund it. That kind of alignment is rare and powerful

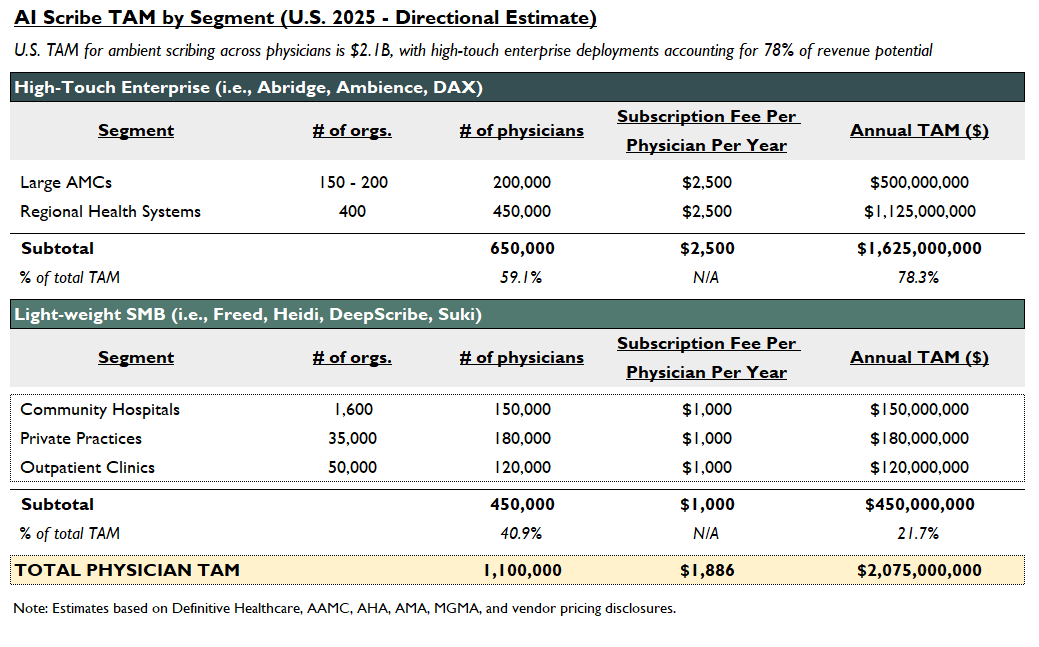

The TAM today is small (~$2B). Expansion into CDI, APPs, and revenue cycle is necessary, but not guaranteed

The product is easy to copy. Defensibility will come from depth, not speed

Every next move—horizontal or vertical—introduces friction. Abridge has to pick its battles wisely

At $5B, the clinical note is the entry point, not the business

The Easy Part Is Over

Just months after closing a $250M Series D ($2.75B), Abridge is reportedly raising another $300M – this time at a $5.3B valuation, led by a16z. A 2x step up, and a 45x multiple on contracted revenue. For a note-taking tool. In a market with a few hundred enterprise buyers.

Unhinged? Yes. Off the mark? Not really.

What makes ambient scribes compelling isn’t the tech. It’s the rare alignment of incentives. Clinicians want relief from the EHR. Boards want to show they’re doing something with AI. That kind of top-down, bottom-up pull is unusual, and explains why adoption has progressed quickly.

But that alignment is only the beginning. The core market to date—low-acuity providers at enterprise hospitals—isn’t big enough to support a $5B+ outcome. To scale, scribe companies like Abridge will need to shift horizontally into messier care settings or vertically into new modules of the tech stack. Ideally, both.

The future depends on scaling beyond primary care, and beyond the note.

What Is An Ambient Scribe?

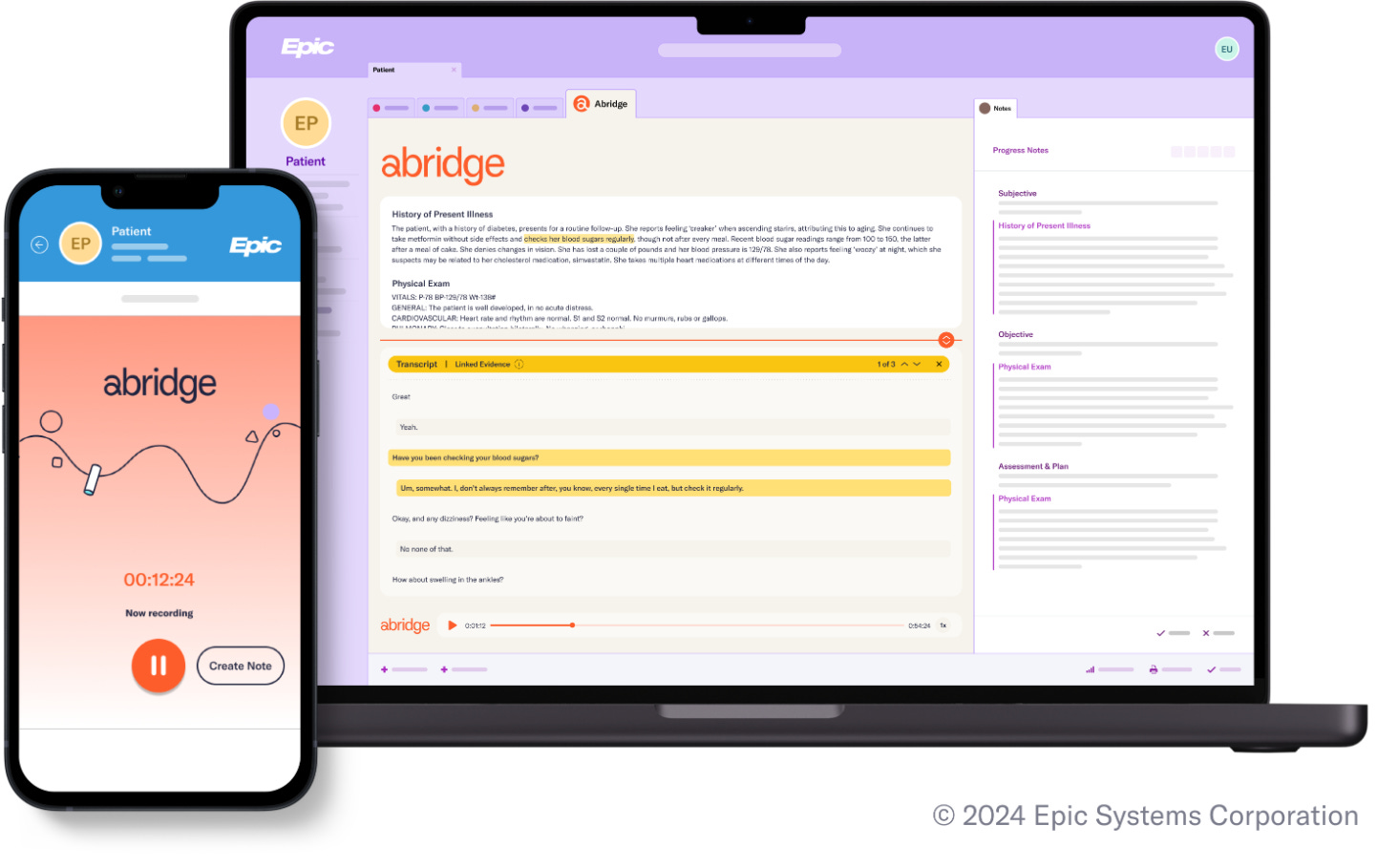

It’s easy to over-intellectualize “AI” in healthcare. But ambient scribes are simple. These tools record clinician-patient conversations and generate structured clinical notes in real time. Audio is typically captured through a mobile device, and synced directly into the EHR. Some products (like Abridge) are embedded inside Epic with a built-in record button. Others run as standalone apps that sync notes back after the visit. But the core is the same: the doctor talks, the note writes itself.

Why Scribe Adoption Is Moving Fast

The numbers fueling the hype: time saved, quality kept, burnout down.

The pitch is simple, and mostly true. AI scribes save time, improve note quality, and reduce burnout. And unlike most tools in healthcare, physicians actually want to use them:

Time savings: Even at Kaiser, one of the more efficient systems, NEJM found that AI scribes saved 40 to 70 seconds per note (NEJM). That sounds small, until you scale it. Across 300K uses (in a year), 3,000 to 6,000 hours were saved.

Increased note quality: Using the PDQI rubric, AI-generated notes scored 4.20 out of 5, just shy of human-authored notes at 4.25 (ARXIV). In low-acuity settings where most scribes are used today, that gap likely doesn’t matter. But in high-acuity settings, like emergency medicine or surgery, the models sometimes missed nuance or failed to capture follow-up planning.

Reduced physician burnout: Stanford physicians using DAX saw a 1.9-point drop in burnout (on a 0 -10 scale). At UPenn, “pajama time” dropped 30% (JAMIA, JAMA). Fewer clicks. Fewer late nights.

Studies aside, these aren’t hypothetical wins. 85% of Abridge users said they’d keep using it (NEJM). One Kaiser physician put it more bluntly:

“You’d have to take it away from my cold, dying hands.” (BOND)

A Rare Moment of Alignment

In the past five months, Abridge’s contracted ARR exploded from $50M to $117M. Even outside of healthcare, that growth isn’t normal. Only a handful of companies have scaled to $100M ARR this fast (BVP). Abridge did it in under two.

Why? Because demand is coming from both ends of the org chart. Boards need a credible AI story. Clinicians want relief from the EHR.

Compare that with the last big infrastructure rollout: EHRs under HITECH. Adoption was mandated, compliance-driven, and painful.

Ambient scribes are the opposite. They’re voluntary. They work. And they’re landing just as TEFCA goes live, bringing 1K hospitals onto a shared data exchange. Now, notes aren’t just recorded. They’re portable, standardized, and auditable.

This is a rare opportunity: a product people want, solving a problems systems are finally read to fix.

Everything Beyond the Wedge Gets Harder

The TAM is limited. Defensibility is shaky. Logical adjacencies introduce friction.

Even with this traction, Abridge’s path won’t be smooth. A few reasons why I believe that’s the case:

1. The Current Market Is Too Small

AI scribes are a feature, not a platform. At $2.5K per physician per year, the high touch market (large AMCs and regional systems) tops out around $1.6B. Add in lower-priced SMB deployment, and the total physician TAM rounds out at ~$2.1B.

That’s real revenue opportunity. But it’s not enough to support a $5B+ outcome without more.

Nearly 80% of that value sits in enterprise health systems. Smaller orgs make up more headcount, but they lean toward cheaper tools like Freed, Heidi, DeepScribe, or Suki.

Importantly, even these TAM estimates assume stable pricing, which may not hold. As adoption normalizes, willingness to pay will compress.

Some providers are already trialing “good enough” ambient tools at half the price. One IDN I spoke with pitted DAX and Abridge against each another to pick the cheaper option.

To justify a $5B+ valuation, Abridge has to expand:

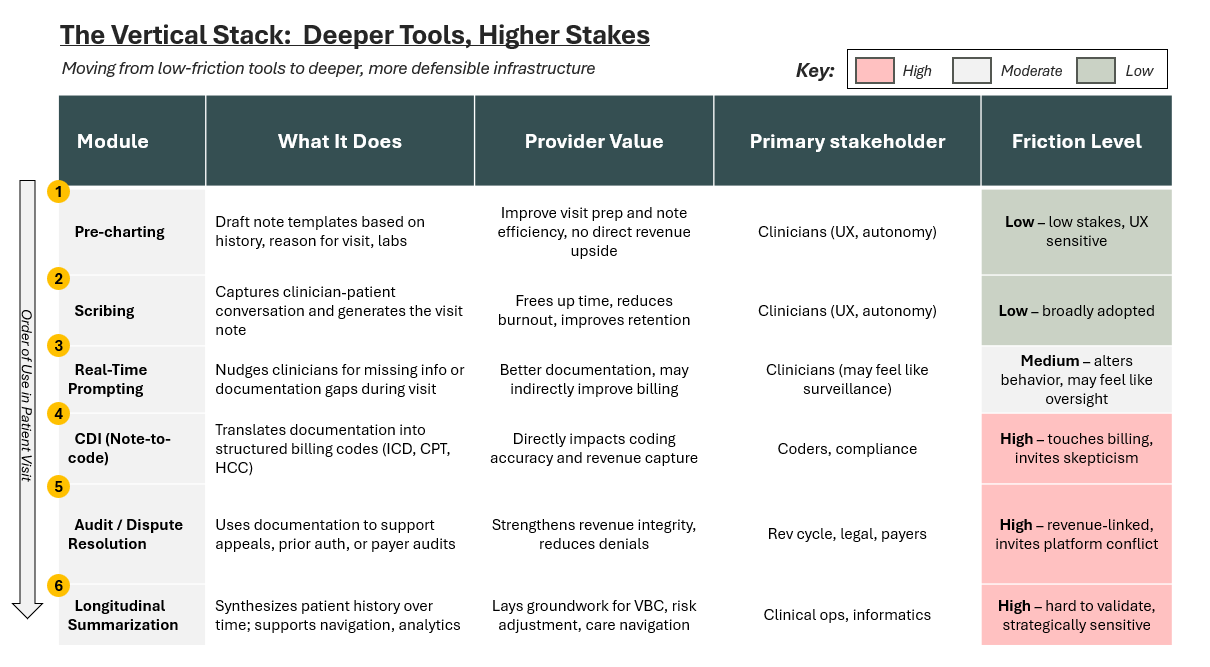

Vertically, into new modules like pre-charting, CDI, and dispute resolution. If even one of these commands similar pricing to scribing, the market gets meaningfully bigger.

Horizontally, into new user types (like 475K APPs, which could expand TAM by $500M at $1K per head) and more complex settings like specialty care and inpatient.

The wedge is real. But the ceiling remains low, and could drop further.

2. Product Defensibility Is Thin

LLM transcription quality is improving fast. Voice-to-note isn’t hard to build anymore. And with low switching costs and no database lock-in (unlike EHRs), these tools are vulnerable. If another vendor integrates better, runs cheaper, or just feels smoother, clinicians will switch.

Like the TAM ceiling, the obvious product-led-growth move is to go deeper: upstream into pre-charting, or downstream into CDI and revenue workflows. But that introduces new risks:

Clinician trust: Once a scribe starts suggesting codes or nudging for follow-ups, it starts owning the clinical narrative. What was once helpful becomes intrusive. If the note becomes a scorecard, will clinicians still opt in?

Platform tension: The deeper these tools go, the more likely they are to compete with the EHR itself. For now, Abridge has made Epic stickier. But the closer it gets to billing and compliance, the more likely it is to trigger conflict..

It’s not just about which module Abridge builds, but about which frictions they’re willing to absorb—a tradeoff we’ll unpack more in the next section.

Depth may build the moat, but it also pokes the bear.

3. Growth Looks Painful In Every Direction

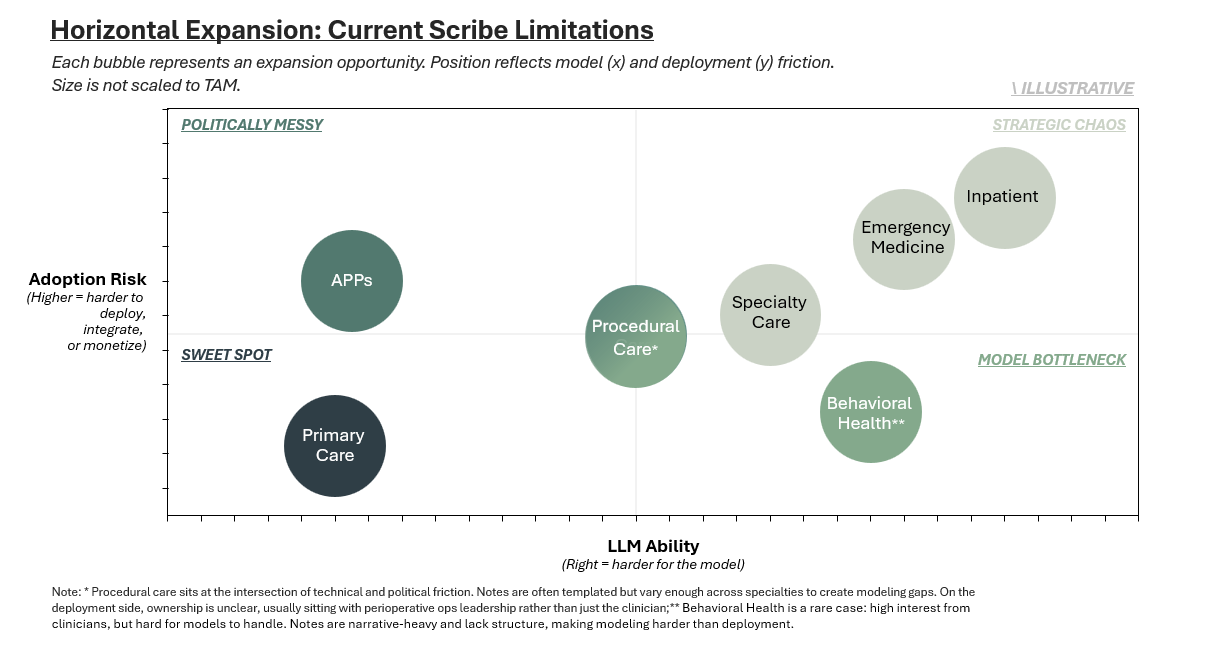

The wedge worked. But the core market is small, and the product alone won’t scale it. Abridge and others will have to expand: horizontally into more complex care settings, and vertically, into higher-stakes infrastructure.

Regardless of direction, you run into the same wall: clinical complexity and institutional friction.

The first exhibit below maps illustrative horizontal limits; where LLM performance and workflow complexity start to break down. The second outlines verticalization risk; how defensibility increases, but so does political exposure, as companies capture more of the tech stack.

There’s room to grow, but no obvious path. Every move beyond the note invites resistance from clinicians, vendors, or from the system itself.

What Everyone’s Talking About, And What Actually Matters

Plenty of smart people are skeptical. But most of the concern is pointed at the wrong risks. Below are the takes I hear most often, and why I think they miss the real threat or might be misreading the signal.

“DAX is going to win this”: They should, but they aren’t. Abridge only slightly trails in size. That tells you something. Microsoft’s product has been slow to deploy and often feels clunky. In this market, product quality still matters.

“Older physicians won’t adopt this”: Some won’t, and that’s fine. But many are. This market isn’t built for the last generation of clinicians; it’s being built for the next one. Imagine what Gen Z resident will think when they’re handed a working scribe day one.

“Hospital sales cycles are too long”: They are, but Abridge is proving urgency and narrative can compress them. The contract growth speaks for itself. This is a distribution machine.

There’s no clear financial ROI: True, in the narrow sense. The original pitch—save time → see more patients → boost revenue—doesn’t work in every setting. Many systems don’t profit from E&M visits. But that misses real lever: clinician retention. In margin-squeezed systems, keeping burned-out staff is its own kind of ROI. And over time, bundling scribes with revenue-generating modules like CDI will help close the financial gap.

Models will hallucinate and make clinical errors: That’s not the real concern today. Scribes summarize what was said; they don’t invent diagnoses or suggest care plans. But as these tools expand into prompting, pre-charting, or CDI, the line between note-taker and decision maker blurs. And once the scribe starts shaping the record, the risk isn’t just hallucination. It’s attribution. Who’s responsible when something goes wrong?

A Reasonable Bet—With Conditions

The raise is aggressive, but far from irrational. If Abridge were just a scribe tool, it wouldn’t pencil.

But as a wedge into structured data, revenue infrastructure, and long-term clinician retention? Then it starts to make sense.

The path forward is far from guaranteed. The market is smaller than people think, the current product is easier to copy than it looks, and every expansion vector introduces friction.

Still, ambient scribes might be the only product in healthcare that clinicians genuinely love—and boards are willing to fund. That’s what makes it investable.

To earn that $5B valuation—and the $15–25B outcome it implies—Abridge will need to scale like few have. For context: Epic generated $4.9B in revenue in 2023.

The money isn’t in the note. It’s in what the note unlocks: speed, structure, scale, and staff who don’t quit.

💭 If this post sparked something—comment or hit the 💗 so I know what’s worth unpacking next. Or forward it to someone building in the space.

Enjoyed this one? You might like The Healthcare 401(k), a breakdown of ICHRA adoption trends, market dynamics and the startups enabling a new era of employer-sponsored insurance.

In-Network is where I write about the business of care: models, margins, and the infrastructure shaping how we deliver it.

Have you done any more posts about Epic? I'd like to understand it better. It seems like a tax on the whole system - expensive, bad UI, huge anti-competitive practices (fighting interoperability)

Great breakdown and assessment. I do think there is underappreciation of the populations that are either unwilling to adopt, have been unimpressed by the results, or where ambient isnt up to speed for certain workflows. I think there are a lot of opportunities for growth but like a lot of health tech, it relies on clinician-informed development and implementation for successful adoption. And the market currently has a lot of noise with half-baked scribes that need to either evolve or peter out and give way to those with more sophisticated options.