Healthcare's 401(k) Moment Is Here

VCs are racing to unbundle outdated employer healthcare, but will ICHRA scale fast enough to justify investor bets?

TL;DR: ICHRA’s steady growth means we’d invest in scalable, tech-forward enablers (like Thatch) but pass on manual, “white-glove” alternatives.

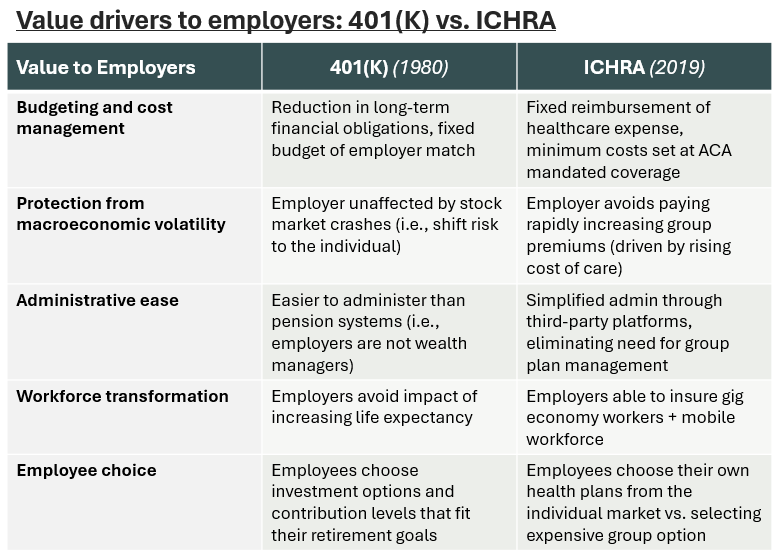

ICHRA transforms employer health insurance into a fixed reimbursement model, like how 401(k)s rapidly replaced pensions in the 1980’s and 90’s

If the Exchange remains stable, ICHRA is theoretically a win for employers (predictable costs) and employees (flexibility and choice in coverage)

While admittedly small (~500K lives), ICHRA has grown at 70% per year and is likely to eclipse ~3.5M+ lives by 2032—reasonable but not earth-shattering scale

Moonshot success here is viable but sensitive—we need sustained premium growth in group options, continued tax credits, and (eventually) large employer buy-in

What is ICHRA, and why now?

For Americans, employment and healthcare are inextricably linked—of the 270M non-elderly insured, 165M (61%) receive coverage through their employer (KFF 2024).

But why do our jobs dictate the ability to receive healthcare?

In the 1940’s (post WWII), rising inflation led to government wage freezes—employers offered health insurance (and pensions) to attract and retain workers.

In the decades that followed, employer-sponsored insurance was plauded for its benefits to employers and payers alike, including:

Natural risk distribution for payers: Workplaces have demographically diverse pools of healthy and unhealthy individuals (i.e., employment generally doesn’t correlate with health status). Carriers could manage large populations without individual underwriting.

Significant tax advantages for employers: Insurance contributions are exempt from income and payroll tax under federal and state law (since the 1950’s).

But it’s 2025 now, and recent macro trends are eroding value:

Premiums are on the rise, with the average cost of employer-sponsored coverage expected to increase by 7-9% (AON 2025, LendingTree 2024, PwC 2024)

Job mobility is now common, with a median job tenure of 3 years for workers aged 25-34 vs. 10 years for ages 55-64 (BLS 2024)

The gig economy is thriving, with 36% of U.S. workers participating as a primary or secondary job (McKinsey 2022)

New models are emerging in response.

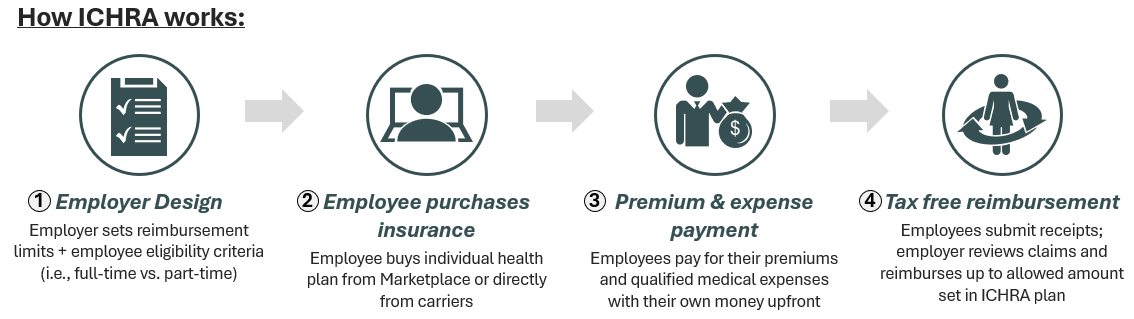

In 2019, the fed created Individual Coverage Health Reimbursement Arrangements (ICHRA). Employees purchase their own coverage on the Exchange or directly from carriers. Employers set a budget, then reimburse the employee for premiums and qualified medical expenses.

We’ve seen movements like this before. During the 1973-74 market crash, employers couldn’t make good on pensions promised decades prior. The fed stepped in with sweeping regulations, creating the common 401(k). Employers were off the hook for lifetime payments, instead offering fixed benefits (“the match”).

ICHRA is the 401(K) of health insurance. Employers lock in fixed medical expenses to hedge against rising premiums, shifting plan purchase and admin responsibilities to the individual.

How does this benefit the employer? The employee?

Imagine group insurance like a fixed-price, corporate buffet. The employer pays the same premium for every employee regardless of their needs or preferences. Some want only a light lunch, while others require specialized dietary options, yet everyone’s “meal plan” costs the same.

ICHRA transforms this model into a flexible dining allowance. Employees have a set amount to spend on meals of their choosing from a variety of restaurants (carriers). Maybe they choose a basic plan that costs less than their allowance (and pocket the difference), or they opt for premium coverage by contributing additional funds.

Employers gain predictable costs and simpler administration, while employees receive the freedom to choose coverage that fits their needs.

How big is ICHRA today, and what can it be?

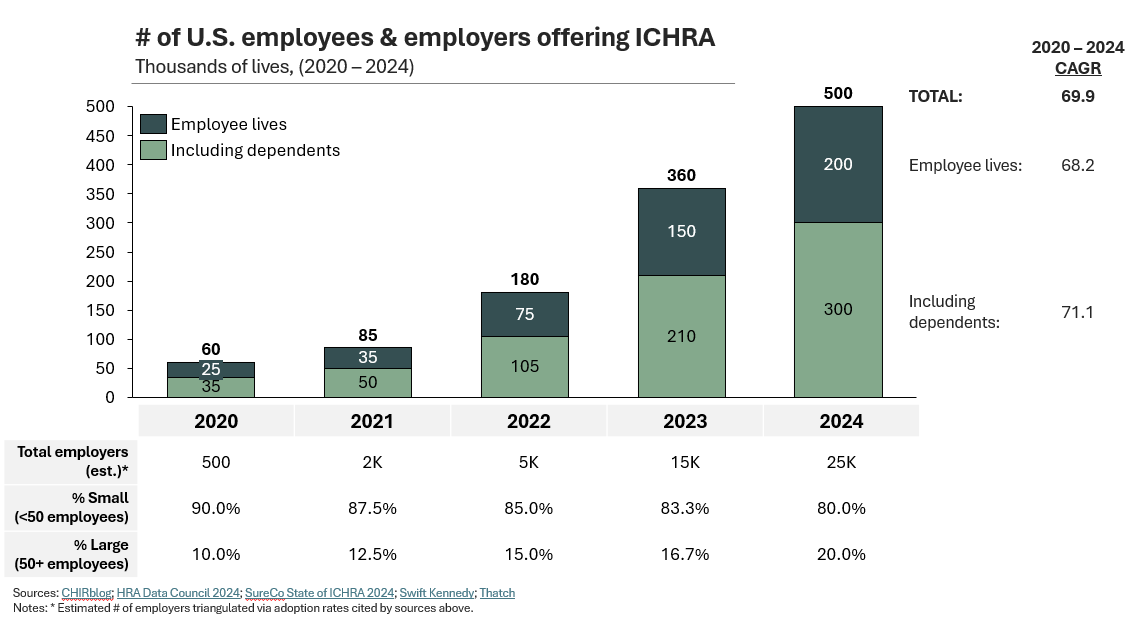

So how big can this get? Admittedly, ICHRA today isn’t a large market—though estimates vary, roughly 300—500K employees have an ICHRA available through ~25K employers across the country (HRA Data Council 2024).

This represents just a fraction (>1%) of small group (11M) and large group coverage (40M) (GAO 2024). But current excitement comes from the rapid growth rate (i.e., 70% CAGR), along with improving penetration and retention (80%+) with large and small employers alike (HRA Data Council 2024).

The demand is there, but before we can project forward, there are two more critical players to understand: 1) the payers and 2) brokers.

Exchange payers love ICHRA. Centene recently named its first president over the new ICHRA line of business. Likewise, Oscar Health is launching an ICHRA-specific billing and enrollment program (“ICHRA Connect”) to facilitate off-exchange plan purchases. This is because:

ICHRA means more lives in the individual market. More lives mean more premiums.

New lives improve the risk pool of the existing LOB. Exchange profitability has improved dramatically for Centene and Oscar (largely driven by 2021 premium tax credits which brought in healthier, middle-income lives). ICHRA lives could help even more.

Quick tangent: Large Commercial insurers remain silent (i.e., United, Elevance, Aetna). And this makes sense – why disrupt a profitable employer group market? At this point, any large-group employer interested in ICHRA might be looking to dump their “bad risk” into the individual market. This penalizes the taxpayer and the unsubsidized individual enrollee, who’ll have to pay up for the increased risk. We’ll discuss more later).

Now onto brokers; initially, they viewed ICHRA with skepticism. With commissions set at 3—6% of premium (and individual premiums lower than group plans), financial incentives appeared misaligned.

However, brokers are increasingly recognizing ICHRA’s strategic advantages:

Market expansion: ICHRA unlocks previously untapped lives, particularly employers with diverse workforces (part-time and seasonal staff)

Client development: Early ICHRA adoption allows brokers to establish relationships with growing businesses. As these companies scale, they become prospects for group coverage.

Operational efficiency: Modern ICHRA platforms (like Thatch) streamline labor intensive processes, like automated member onboarding, simplified plan selection, and more.

While ICHRA may yield lower margins, reduced admin burden and expanded market opportunities make ICHRAs an increasingly attractive product for forward-thinking brokers.

But back to the point, what could the market here look like in 5 – 10 years? A few triangulations below:

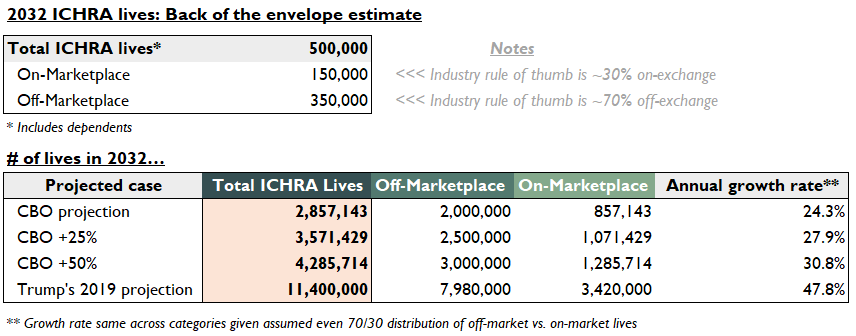

For our low case, take the CBO. By 2032, they estimate roughly ~2M people (including dependents) will enroll in ICHRA off-the marketplace (CBO 2024). The industry rule-of-thumb is that ~70% of individuals enroll off-exchange (they prefer to purchase plans directly from insurers / brokers, see conversation here). So that 2M equates to 2.9M total ICHRA lives.

A hyperbolic case would be the Trump admin’s projection of 11.4M total. That’s half of total exchange enrollment today, or 100% of Exchange enrollment in 2020 (prior to premium tax credits).

Historical growth rates of ~70% give us reason to believe in potential overperformance above the CBO, with a 28 – 30% growth rate leading to 3.5 – 4M lives in relatively short order. Solid scale, but not the earth-shattering scale proselytized by folks in venture-land.

What you need to believe to bet on ICHRA

Projections are great, but what will determine the migration of these lives? Regardless of strong market tailwinds, we believe five key things need to happen for ICHRA to achieve critical mass:

Traditional options stay expensive. Over the past decade, small group enrollment has fallen at ~7% p.a. (Mark Farrah 2024), with premium increases reported above 10% p.a. for over half of small businesses (WSJ 2024). Though large group enrollment is stable (GAO 2024), premiums increased by 8%+ p.a. (PwC 2024). Continued adversity forces employers of all sizes to reconsider and view ICHRA as a viable solution.

The Exchange stabilizes via continued premium tax credits. If PTCs vanish, upwards of ~7M people could leave the ACA. A smaller (and likely less healthy) population means premiums could grow by 75% (KFF 2024). If ICHRA is no longer a low-cost option for employers, it’s dead-on-arrival. Trump may back ICHRA for its support of small business, but ironically Republicans have voiced their dislike of the ACA. The states of West Virginia, Louisiana, Ohio, Indiana, and Tennessee saw the largest year-over-year increases in enrollment. It’s tough to predict where things land.

Large groups convert to reach critical mass. It isn’t unreasonable to believe large employers could see the Individual Marketplace as a preferred risk pool vs. their own company – even the largest company is smaller than a state-wide risk pool. That said, folks like United, Elevance, and Humana, won’t let their most profitable LOB churn without a fight. But then again, neither did Vanguard or Fidelity, who both initially resisted the 401(K) (“a niche product for high earners”) before rapidly playing ball to avoid losing share.

Our last two drivers are more tactical.

Exchange plan networks improve. The quality of marketplace plans remains variable. Though ICHRA will likely carve in many employees who previously didn’t receive coverage at all, one would hope that overall member growth allows for improved coverage at reasonable prices.

Employer Adoption is made easy by third party vendors. Asking employees to enroll on the Exchange is more complex than group enrollment. Employers will require assistance from one of many ICHRA enablers to comply with federal regulations and ensure successful enrollment + reimbursement for employees.

Our final pulse

Though enrollment is small today, ICHRA is a ripe market with demonstrable market tailwinds and a clear value proposition to employers of all sizes.

Stroke of the pen risk via premium-tax credit continuation, Commercial payer resistance, and the volatility of the Exchange market may give some folks pause, but no market with asymmetrical upside exists without its fair share of caution.

We’d like scalable, tech-forward offerings with unit economics that don’t require moonshot member growth to return the fund.

Quick bonus: Market landscape

As a bonus here, we jotted down a few of the leading players in the space. In particular, we’re big fans of Thatch—their slick, employee facing tech platform + payment processing infrastructure look to be real differentiators in a space rife with manual complexity. Other players offer customizable, “white-glove” services, but we’ve found the majority to be highly manual under the hood.

Thatch: Tech forward platform with payroll integrations (ADP, TurboTax). Automated premium payments + reimbursement infrastructure.

Venteur: AI-driven decision engine with direct premium payments (no employee reimbursement claims)

Remodel: Enterprise grade solution for large employers. White-glove broker partnerships + 200 HRIS integrations.

SureCo: Large group specialist. Claimed 22% avg premium savings + compliance certainty.

TakeCommand: Education-first platform, small business resources, Medicare integration tools.