Yes, MA is still a big opportunity

Growth is slowing as MA matures from volume to value, but several carriers (and SNPs) remain strong amidst the correction

The final pulse:

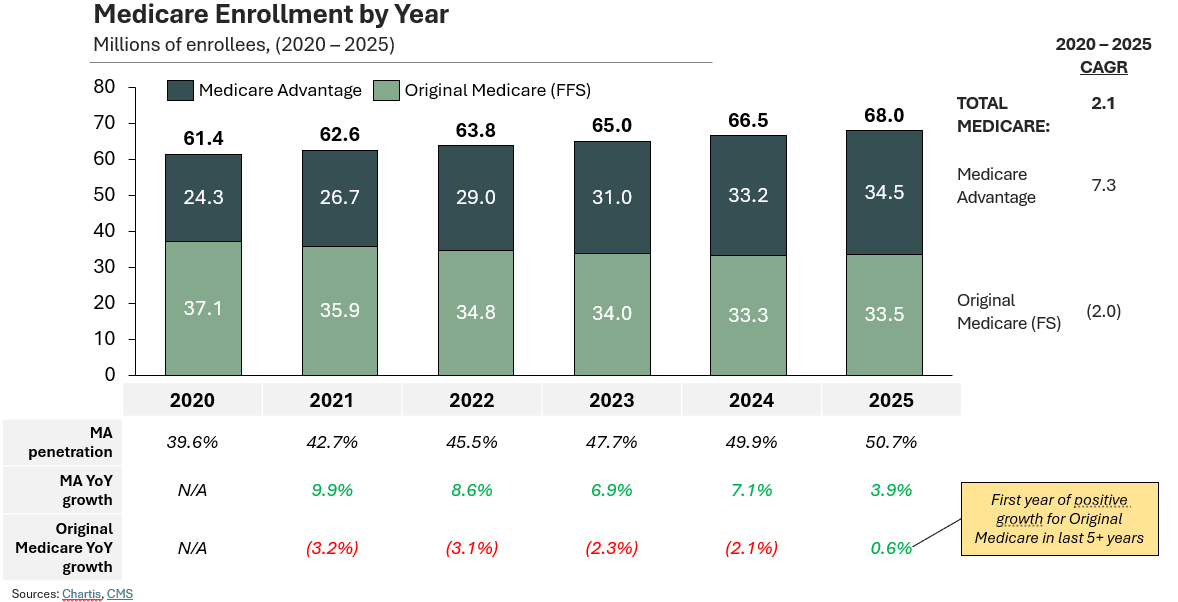

MA had its biggest year ever (34.6M lives) and continues to grow, just slowly at 4% vs. 7-10% seen historically

Degrading MA benefits + PPO plan departures led to Original Medicare’s first ever growth year in recent memory, netting +200K new lives

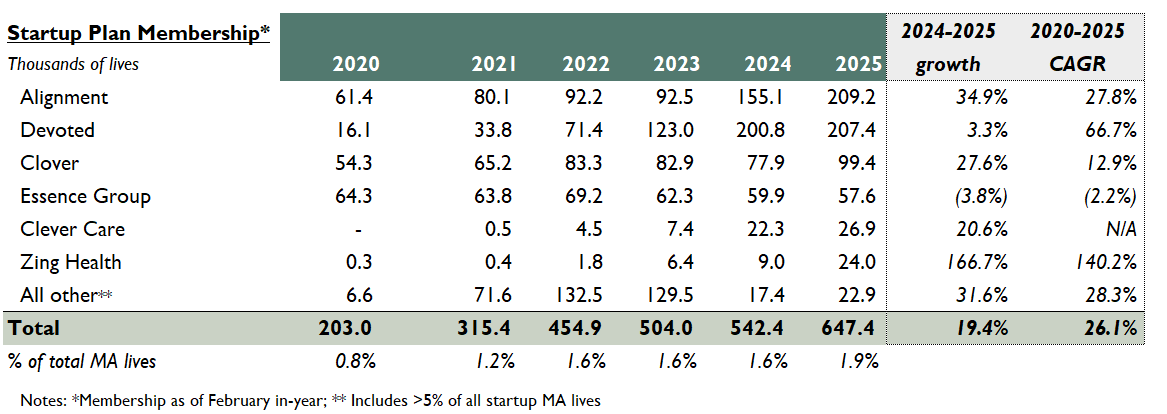

Though national for-profits continue to dominate MA share (particularly United + Elevance), startup plans with patient-centered benefits packages now cover ~2% of all MA lives

In the near-term, SNP plans will be payers’ growth lever; enhanced PMPM payments benefit top-line, and D-SNPs are particularly interesting (the effective utilization of Medicaid dollars à savings on Medicare)

Current State of Play in MA

Last year, several market headwinds emerged for Medicare Advantage.

Rising utilization, particularly unmet demand for ortho + CVH outpatient surgeries

Surging MLRs, approaching 90% vs. historical 85%

Low rate increases from CMS (3.7% avg increase)

Growing regulatory scrutiny around financial levers (RADV audits, more prior auth)

The above led to carriers signaling their intent to slow (or even contract) their MA books for the 2025 Performance Year.

We have the data now. And though MA growth is slowing down, that takeaway alone is the tip of the iceberg. Here are the key points to know:

Medicare Advantage growth has indeed fallen from 7-10% p.a. rates down to 4%

That said, MA still achieved a record number of total beneficiaries (34.5M) and eclipsed 50% penetration nationwide (with 50%+ penetration in 27 states).

Original Medicare enrollment grew for the first time in 5+ years, adding 200K new beneficiaries incentivized by expanded coverage and minimal premium growth

Despite plan departures, MA market share remains with for-profit carriers (vs. provider-sponsored, non-profits, the Blues); this year, United and Elevance grew much more than Aetna, and Humana lost 10% of total membership

The resurgence of Original Medicare (OM) is the headline. In addition to the media’s ongoing critique of MA, OM’s comeback could be attributed to several intrinsic factors:

Benefit reductions in MA plans: More than 60% of MA plans reduced supplement benefits, including OTC meds, transportation, and meal services (source).

Improvements to OM benefits (with low premium increases): OM expanded coverage, including mental health benefits (covered marriage counselors, family therapists), cardiovascular risk assessments, and care navigators (PIN). Premiums only rose slightly ($175 à$185 a month) (source).

MA PPO plan departures: More than 1.8M members were enrolled in 2024 plans not offered in 2025. The vast majority of departing plans were PPOs offered by Humana + CVS (source). The proliferation of PPO plans in recent years (to attract membership) seems to met an end.

United and Elevance are this year’s victors; startup plans show promise

In terms of competitive distribution, things are less exciting. 70%+ of MA lives still live with for-profits, whose market share continues to grow at a steady +1% per year. Though other carrier types are indeed growing membership, these gains only allow them to maintain current share (i.e., provider-sponsored plans (8%), non-profits 98%), Blues (11%).

Amongst the for-profits, United and Elevance are the winners of this year’s AEP, capturing 50%+ of total net new lives. Aetna captured just 9% of total new lives, while Humana saw active deterioration of their book (CMS / others consider Elevance a “for-profit” plan as a publicly traded company).

The most exciting development here is that (despite Oscar’s departure and the sale of Bright’s MA plan to Molina), startup plans now comprise ~2% of total MA lives. The leading edge for these folks is patient-centered, culturally competent benefit packages that effectively speak to consumer needs.

These are just the highlights; for more numbers than you probably need, Chartis has a fulsome competitive analysis here.

Moving Forward, Plans Will Double Down on SNP

SNP is the new growth frontier; it’ll be the “MA” of the last decade in the years to come.

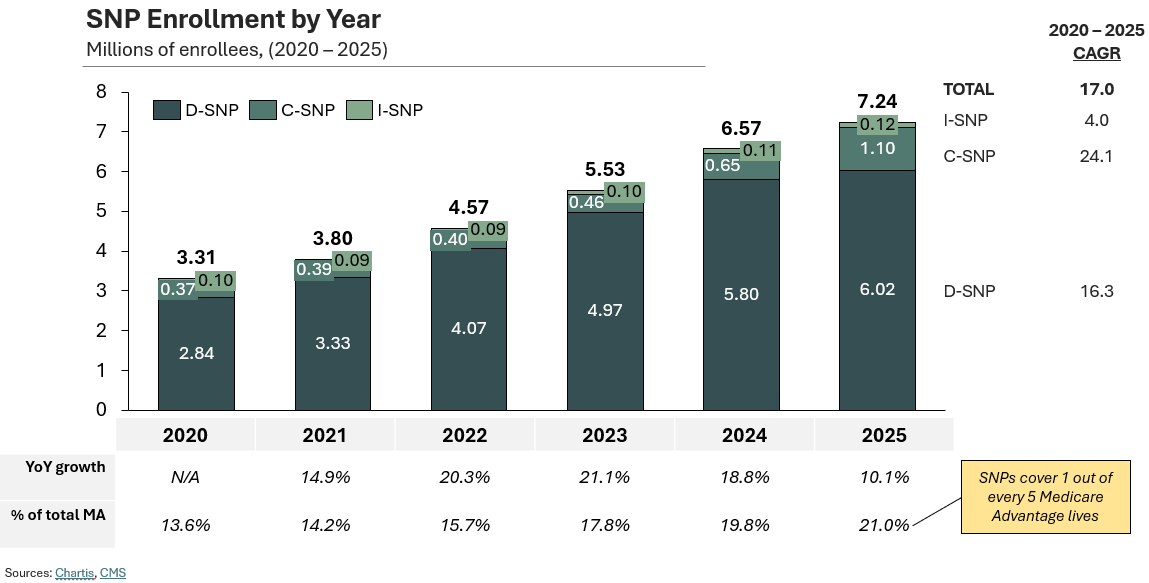

Broader deceleration in standard MA is revealing the relative opportunity in Special Needs Plans (SNPs), which reached critical mass this year and eclipsed 7.2M lives (17% 5-yr CAGR).

Now, 1 out of every 5 individuals in MA is now enrolled in a SNP. And apparently, 50% of this year’s new MA enrollees elected SNPs (source).

D-SNP remains the prevailing model (83% of total), but the jump in C-SNP to 1.1M lives (+68%) is both staggering and unsurprising given what we know about the proliferation of chronic care needs (i.e., heart disease, diabetes).

Like many, I’ve been a loud proponent of SNPs for years. High acuity patients with chronic conditions, institutional care requirements, or dual-eligible status receive a more individualized MA product focused on care coordination and resource alignment.

For payers, network construction, claims adjudication, and ultimately MLR management here are undoubtedly more complex than with boiler-plate MA. Which is why SNPs received less attention in prior years. Standard MA was enough to make a buck.

But with CMS rate increases below par, the enhanced payment opportunity of SNPs (either through higher risk-adjusted payments for I and C-SNPs or braided Care + Caid funding for D-SNPs) is too attractive to turn down.

(I didn’t forget about PACE programs – but more on that in a future post…)

The usual suspects here are already committed, with the top five plans capturing 75%+ of the total market. More specifically, United has a nationwide I-SNP of 50K+ lives, Aetna has a Florida D-SNP w/20K lives, and SCAN’s maintains a California C-SNP w/15K lives), but we’ve also seen exciting activity from disruptors. To highlight a few, Zing, Curana, and Belong.

This is an area to watch in the days to come.

MA’s Next Chapter: From Volume to Value

Regardless, the challenges are only just beginning. STAR ratings are on the decline, with only 64% of plans earning 4+ stars (down from nearly 80%). Only 2% of members are now in 5-star plans (lawsuits incoming on how these are calculated).

As Medicare Advantage transitions from its high-growth adolescence to a more measured maturity, the industry faces both consolidation and innovation. While traditional growth levers may be weakening, specialized offerings for complex populations represent the frontier of opportunity. For payers willing to invest in the capabilities needed to serve these populations effectively, the future of MA remains bright—not despite its challenges, but because of them.

Bonus: Will the Trump Admin Help Or Hurt MA?

MA was a hot topic coming out of Dr. Oz’s confirmation hearing last week. The question on everyone’s mind: what will the Trump admin do with MA?

Of course, Trump was a strong proponent of MA during his previous term. Currently, nothing suggests this next term will be any different.

Setting aside the fact that Dr. Oz used to sponsor MA ads (see here), his confirmation hearing highlighted the “bureaucratic processes” riddling MA, signaling support for the automation of utilization management.

“We spent about 12% of the CMS budget on bureaucratic processes, the admin of the program…I believe we have the power right now, with tech that didn’t exist from three or four years ago, to automate a lot of these processes, and preauthorization is a good example…”

Right or wrong, more pre-auth by a non-human likely means more restricted access to care.

If Trump were to accelerate Medicare privatization, we can expect:

Rate increases through CMS’ annual notice

The unwinding of MA marketing restrictions, including Biden-era requirements that all TV ads be approved by CMS, agent / broker compensation caps, and third-party marketing organization oversight (recorded phone calls)

Unlikely, but make MA the default enrollment mechanism (see Project 2025)

That said, it’s now accepted by folks from both sides that the fed pays insurers 20% more for MA enrollees than it pays for similar people on Original Medicare (+$84B in cost in 2025, source).

For context, the CBO projects payment of ~$71B under the physician fee schedule (Part B) to treat OM patients in 2024 (source).

And so, to be even keeled, if Trump goes the “protect the budget” route to drive savings but slow MA further, we’d expect to see:

Tightened rate increases, again via annual rate notice

The end of quality bonus programs, which increase Medicare spend by $12B a year (source)

Capped benchmarks at 100% of local traditional Medicare costs (source)

Which pathway seems more likely? I’ll let you decide.