Medicare’s Billion Dollar Bet on Care Navigation

Medicare’s new care navigation program isn’t just much-needed reprieve for families; it’s a huge investment opportunity for providers + VCs alike

Two years ago, when my sister’s test results came back “inconclusive” for the third time, I didn’t just worry—I did what any anxious “finance guy” would do. I made a spreadsheet.

Column A. Specialists and office phone numbers (today, there are seven across three different academic medical centers).

Column B. Office visits, labs, and other “technical” encounters (40 and counting).

Column C. Direct quotes from our health plan EOB, reassurance the visit would be covered.

What started as a dashboard quickly evolved into a labyrinth of medical jargon. In time, I added a Google Drive to capture referrals, treatment plans, and a symptom tracker.

I didn’t choose to become my sister’s care navigator. Like the ~38M other Americans supporting loved ones through complex medical journeys, I became one out of necessity (AARP).

Now, a new Medicare benefit seeks to professionalize this role through Principal Illness Navigators (PINs), transforming how Medicare beneficiaries experience care coordination—and birthing a significant market opportunity in the process.

Principal Illness Navigators Explained

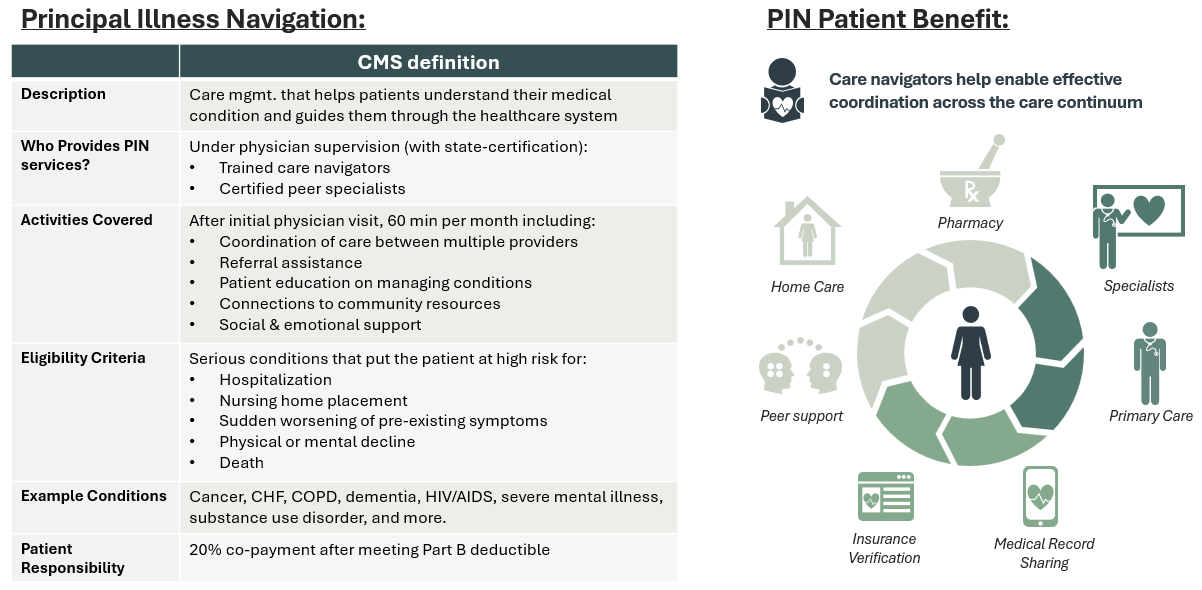

Introduced October of 2024, PINs are a fresh Medicare benefit covering professional care navigation services for patients with serious, high-risk conditions lasting at least three months (CMS). Notable disease areas include cancer, HIV, or substance-use-disorders, but the CMS notice seems to cover a variety of conditions. Use cases in initial years will vary.

So why did CMS add these benefits now? For that, we can thank the GUIDE program, CMMI’s latest model aimed at improving outcomes for patients with dementia. Like most wrap services offered by value-based providers and MSOs, early feedback suggests effective navigation can compress spend + improve outcomes (Performance Year 1 ends in June 2025).

Federal support for this market is exciting for patients & families, but also for providers + investors. This is a billion-dollar market.

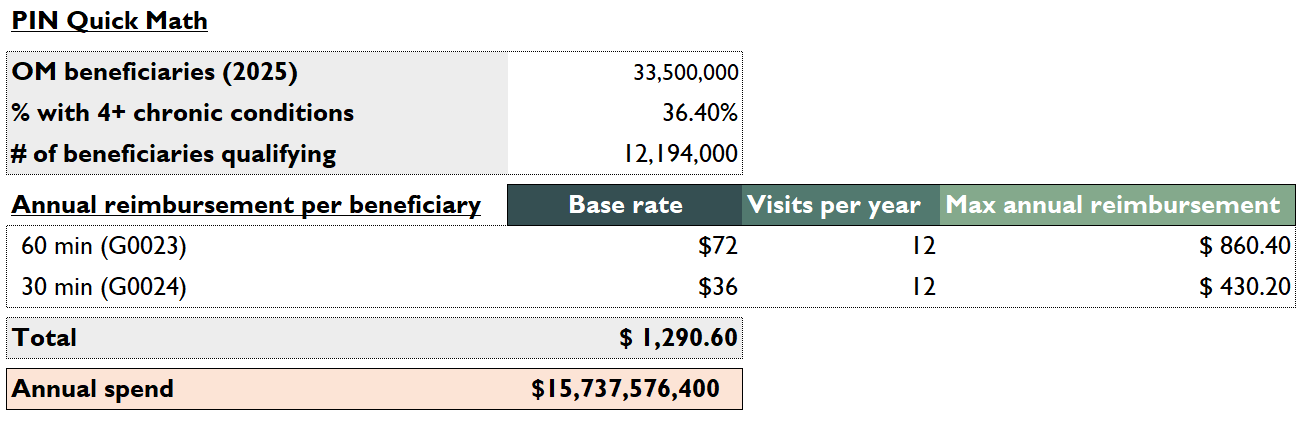

Let’s do some quick math. Of the 33.5M Original Medicare beneficiaries, ~36% have four or more chronic conditions (CDC). A conservative 12.2M may qualify for PIN.

CMS added four new HCPCS codes; two for PIN navigators (60 min G0023, 30 min G0024) and two for peer support (60 min G0140, 30 min G0146). Sixty-minute codes bill at a base rate of $72, 30 min at $36. 60 min codes are capped at 1x per month, while 30 min codes are uncapped but must be “justified and documented.”

Let’s assume maximum utilization: 12.2M people, twelve 60 min visits per year, twelve 30 min visits per year, all billed and collected 100%.

Shooting for the moon gets us a ~$15B+ bucket of spend. And though utilization will never reach this peak (I expect CMS to tighten eligibility criteria in the coming years), remember this doesn’t include MA. Expect non-SNP MA plans lacking similar supplemental benefits to follow OM’s lead. Success here may eventually trickle down and reach Commercial insurers.

Who’s Building Solutions

In terms of folks chasing the opportunity here, there are three key plays we’d like to quickly highlight, each with their own unique angle on PIN:

Solace Health: Marketplace, MSO model directly connecting certified care navigators with Medicare beneficiaries, focused on back-office support (i.e., credentialing, billing, licensing).

Guideway Care: Care navigation and SDoH platform integrated with hospital workflows, partnered with health systems to focus on reducing re-admissions.

Innovacer: Interoperability platform supporting care teams by automating admin tasks + identifying high-risk patients, ripe for expansion into actual service delivery.

Of these, I like Solace’s approach. The thesis mirrors Headway, Finni Health, and other non-MD MSOs.

Acquire patients (D2C, PCP partners, health systems, post-acute, etc.)

Create a high-performing network of fragmented providers who can serve them

Market that network to payers with broad network adequacy needs

Build back-office admin, benefit from scale (credentialing licensing, billing, and more)

But unlike Headway or Finni, who both have benefited from PE focus on behavioral health and ABA, there are significantly less care navigators than behavioral health professionals (tens of thousands vs. closer to ~1M psychiatrists, psychologists, MH counselors, social workers, etc.).

And one could argue that care navigators are much closer to 1099 contractors (working on behalf of physicians) than solo practitioners utilizing MSOs as a tool for co-building a private practice.

Candidly, I’m not in love with single-threading any business in healthcare—the potential for FWA here means stroke of the pen risk is real.

Regardless, expect the number of care navigators to skyrocket in the years to come.

The Road Ahead

My sister isn’t covered by Medicare. For now, she’s stuck with me (+ the captive care navigator from our private insurer).

She also lacks a definitive diagnosis, another layer of complexity in our navigation challenges.

But for millions of Medicare beneficiaries and their families, PIN represents a monumental shift—from navigation as a burden to a federal benefit. It acknowledges what patients have known for decades: coordination is care.

As the program scales, we’ll likely see rapid innovation in how these services are delivered, measured, and optimized. The most successful companies won’t just chat and facilitate appointments; they’ll fundamentally reshape how patients experience our fragmented system.

And for investors watching this space, that’s a story worth following closely.